Source: Company earnings reports.

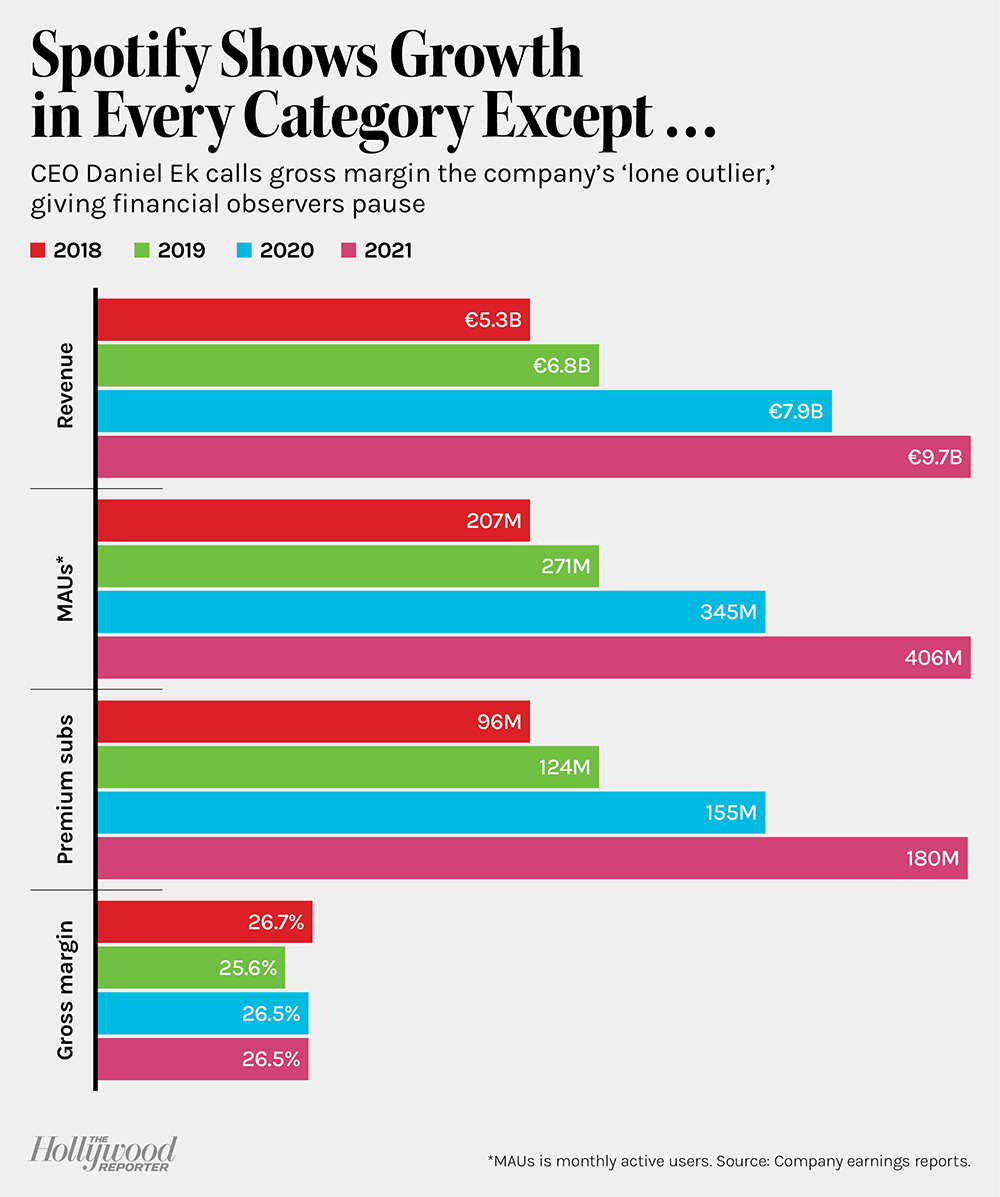

Since Spotify went public in 2018, the music streamer has grown its subscribers, active users and revenue. But questions about its profitability outlook often have been seen as keeping a lid on its stock. CEO Daniel Ek acknowledged as much June 8 during its first investor day in years. Some might think that “we’re a bad business, or at least a business with bad margins for the foreseeable future,” Ek said, calling gross margin the “lone outlier” among key performance metrics that have otherwise delivered gains since 2018.

Gross margin is a profitability measure expressed in a percentage, which is calculated by deducting the cost of goods or services sold from the revenue they generate, divided by that revenue, with that result multiplied by 100. In Spotify’s traditional core music business, the cost includes royalty payments to labels and artists. (The audio giant made $7 billion in royalty payments last year, up from $5 billion in 2020.) “There’s two possible explanations for this lower gross margin result,” Ek argued. “One might be that Spotify simply isn’t that good a business. And the other is that we are investing behind the strength of our business to make the business bigger, stronger and more resilient.”

With new disclosures, Ek touted that the latter was the case, sharing that the company’s traditional core music business is “doing much better than you think,” with a gross margin of about 28.5 percent, above the company’s overall margin and “significant progress in reaching our 30 to 35 percent long-term goal.” (Among rivals, Apple reached a gross margin of 43.8 percent in the final calendar quarter of 2021.)

Spotify usually reports companywide figures, which include investment-heavy emerging businesses. “What’s been dragging it down is our move into podcasting,” Ek explained of its gross margin, vowing that losses would peak this year, which should help change the narrative. After all, podcasting is “not yet profitable,” but has a 40 to 50 percent gross margin potential longer-term, he touted.

That’s partly why Spotify has gone on a buying binge in the space in recent years, including snapping up such podcast creators as The Ringer, Gimlet Media and Parcast. Spotify at its investor day said it has spent $1 billion on its expansion into the space, which it expects to become a $20 billion business for the firm. Chief content and advertising business officer Dawn Ostroff said podcasting brought in roughly $215 million in ad revenue in 2021, forecasting this would increase in 2022.

Many on Wall Street took the new insight as a positive sign. “In the four years since its direct listing, Spotify has doubled its revenue and monthly active users, but its gross margin has remained unchanged — the single biggest factor behind Spotify’s share-price underperformance, we believe,” Evercore ISI analyst Mark Mahaney wrote in a report, adding that the company has made strides in addressing investor worries. “We think the company made some solid progress addressing investor concerns about its ability to scale profitability with greater disclosure on its core music gross margin, the progress of podcasting profitability and long-term margin drivers with contribution from future vertical expansions,” including moves into sports, news and education.

Mahaney said he “came away with incrementally greater confidence in Spotify’s ability to deliver gross margin expansion next year” based on key disclosures, including management’s commitment to “2022 being the peak year of podcasting’s drag on overall gross margin.”(Mahaney has an “outperform” rating on the company’s shares with a $235 price target.)

“In just three years, we’ve not only become a leading platform for creators and listeners, but we’ve expanded the very format of podcasting itself,” Ek touted. “All of these investments have resulted in user growth, retention and increased engagement, with overall consumption hours reaching all-time highs quarter after quarter.”

Bank of America analyst Jessica Reif Ehrlich similarly argued in a report, “Gross margins should expand as podcasting approaches break-even in the next one to two years.” And she raised her 2025 revenue and gross margin forecasts, the latter from 27.9 percent to 29.2 percent. “We view Spotify’s gross margin trajectory as the key controversy among investors,” Reif Ehrlich explained in reiterating her “buy” rating and $164 price target, compared with the company’s recent price of around $112. Her conclusion: “The inflection in podcasting should be a key driver of future margin improvement.”

Morgan Stanley’s Benjamin Swinburne, who has an “overweight” rating and $170 price target on the stock, also came away from the investor day optimistic, saying that execs painted “a picture of a business that has had more success than was evident in the consolidated reported financials over the past few years.”

Source: Company earnings reports.

This story first appeared in the June 15 issue of The Hollywood Reporter magazine. Click here to subscribe.