For much of Hollywood, things are looking rough right now. Streaming subscriptions seem to be stalling, with Netflix reporting subscriber losses for the second straight quarter (the first time that’s happened) and NBCUniversal’s Peacock flat on growth quarter-to-quarter. Advertising is in worse shape, with Apple, Roku, Snap and Meta seeing a slowdown in spend and NBCU CEO Jeff Shell telling analysts that, indeed, the market is “choppy.”

But as bad as things appear in the core media business models of subscriptions and ads, there is another area that seems to be booming, with no sign of slowing down soon: live events and theme parks. And companies that have this revenue stream may be able to ride its wave until the choppiness elsewhere subsides.

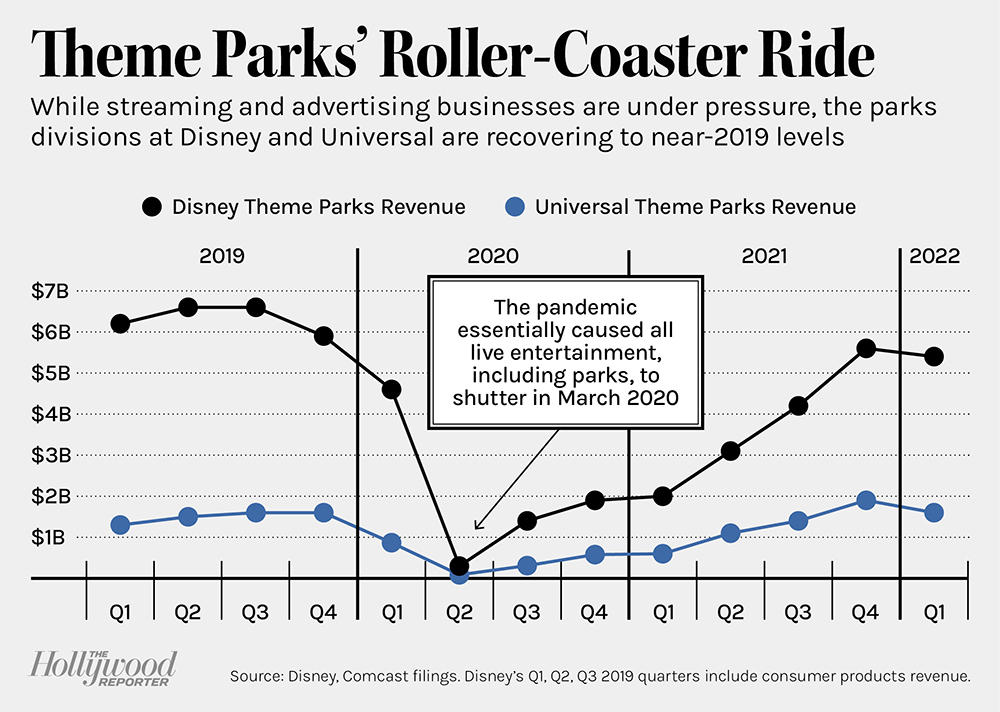

Consider NBCU, which reported its Q2 results July 28. The company says its U.S. theme parks in Orlando and California are trending above 2019 levels financially. “Obviously the Parks business historically has been subject to macro trends and there’s no reason to think that that won’t be the case in the future,” NBCUniversal CEO Jeff Shell said during Comcast’s earnings call. “When we look at our business we’re just not seeing it yet in our numbers and our performance. And we’re putting up these numbers despite the fact that our international visitation domestically is about half of what it has historically been.”

The numbers bode well for Disney, which reports earnings Aug. 10 as it faces investor pressure over its streaming business. The strength of the parks could help mitigate investor concerns about near-term streaming or ad concerns. To that end, Disney execs have been putting theme parks front and center. Last quarter, CEO Bob Chapek started off his investor call speaking of the “fantastic performance” of the domestic parks, in which per capita guest spending grew by more than 40 percent compared with 2019. This came even as the domestic parks are still capping attendance numbers. (Disney used the pandemic to transform its parks business, launching a new pass system designed to extract more revenue from frequent visitors. It also launched such products as Genie+ and Lightning Lanes, which offer tempting upsells to guests.)

The parks have been an important part of Disney’s recovery story and have helped the company bring down its leverage ratio, which had been high in the early part of the lockdown, Disney CFO Christine McCarthy said at a May 18 MoffettNathanson conference: “Our recovery, primarily driven by theme parks, has really given us the opportunity to take that leverage down.”

And, as Morgan Stanley analyst Ben Swinburne wrote in a July 1 note, the parks could even be a “hedge” against a possible recession. “We think pent-up demand is clearly playing a role in the current Parks strength, which along with Disney’s yield management investments may allow the business to grow even in a modest recession,” he wrote.

Parks are far from the only sector seeing a boom moment. The live events that have been able to stage post-COVID returns seem to be flourishing, even amid larger economic concerns. A source at an agency with exposure to the live music and events sector says the pent-up demand is real.

“Demand is still insane. If there’s a recession, we aren’t seeing it in that space. Tickets are still flying, and at higher prices than before the pandemic,” this source adds, noting that they were “not sure how long it can last, but there’s no sign of it slowing down anytime soon.”

That demand could further boost Live Nation, the dominant player in the live music space. While live events may still be impacted by inflation or other economic factors later on, they have the benefit of stifled demand from the pandemic, a bountiful supply of talent and tours (which had also been constrained during the lockdown) and the advantage of presold product, Macquarie analyst Paul Golding wrote in a July 5 note.

Live Nation already has signaled that it expects to reap the rewards from this trend, with the company anticipating a record 2022, driven by high demand in the U.K. this summer, and 2023 (with more than 60 tours already under discussion). The company also recently re-signed CEO Michael Rapino to a multiyear deal that could be worth as much as $30 million annually, justifying the hefty pact by noting that Live Nation is on pace to serve 100 million people in 45 countries this year, a record for the company.

Madison Square Garden Sports, while dependent on the popularity of its teams (the NBA’s Knicks and NHL’s Rangers), also has been seeing a high level of demand for its sporting events, notes Golding, with season ticket renewals in the last quarter hitting 85 percent, suite revenue coming in above pre-pandemic levels and March ticket levels at the highest of the season. And it isn’t just ticket sales. According to Shell, consumers who have been going to Universal’s parks have been spending more per person than they did pre-pandemic. He adds that “we’ve seen no weakness in that coming out of the quarter into the next quarter.” That means food, merchandise and other ancillary revenue is rising alongside ticket sales.

For firms like Comcast or Disney, with ample exposure to that world, the diversified revenue streams could help smooth out what is looking like a bumpy year for the entertainment business. And for other companies with a presence in live events, like the WWE (which would benefit from a boost to its bottom line as sale speculation heats up) or Endeavor (the owner of the UFC and the Professional Bull Riders league in addition to a healthy music representation business), it could even be a source of growth.

In other words: Advertisers may be scaling back their ad buys in anticipation of a slowdown as consumers become more cost-conscious about where they spend their streaming dollars.

But when it comes to a family vacation or a concert, all bets are off, and wallets remain open.

This story appeared in the July 27 issue of The Hollywood Reporter magazine. Click here to subscribe.