After initially touting its advertising-supported offering as a lower-cost option to bring in subscribers, Disney+ is now concentrated on maximizing profitability.

When Disney+’s ad tier launches, in December, it will cost U.S. customers $7.99 a month, the current price of the service’s ad-free tier. The price of the no-ads version will be hiked to $10.99. The increased focus on the bottom line raises questions about how Netflix will price its upcoming ad-based tier and how major rivals could respond with their own price increases.

The Bob Chapek-run Hollywood giant revealed the new pricing Aug. 10, just as Disney reported strong third-quarter earnings. The company showed solid momentum and spending at its domestic parks, as well as growing subscriber numbers, overtaking Netflix for the first time with 221 million total subscriptions across its bundle. Both factors show resilience among consumers, according to Disney executives, even in light of inflationary concerns. That, combined with the media giant’s investment in content, helped clear the way for a higher price point for the ad-supported tier. Plus, analysts say the platform has been underpriced from the beginning, both in terms of its content and compared to competitors.

“We thought that this was the perfect time to go ahead and bring up that price-value equation, so that we’re more accurately reflecting the value that a guest or a consumer or viewer gets with Disney+,” Chapek said on CNBC on Aug. 11.

The increased pricing notably comes several months after Kareem Daniel, chairman of Disney Media and Entertainment Distribution, announced the tier’s launch in March, saying, “Expanding access to Disney+ to a broader audience at a lower price point is a win for everyone.”

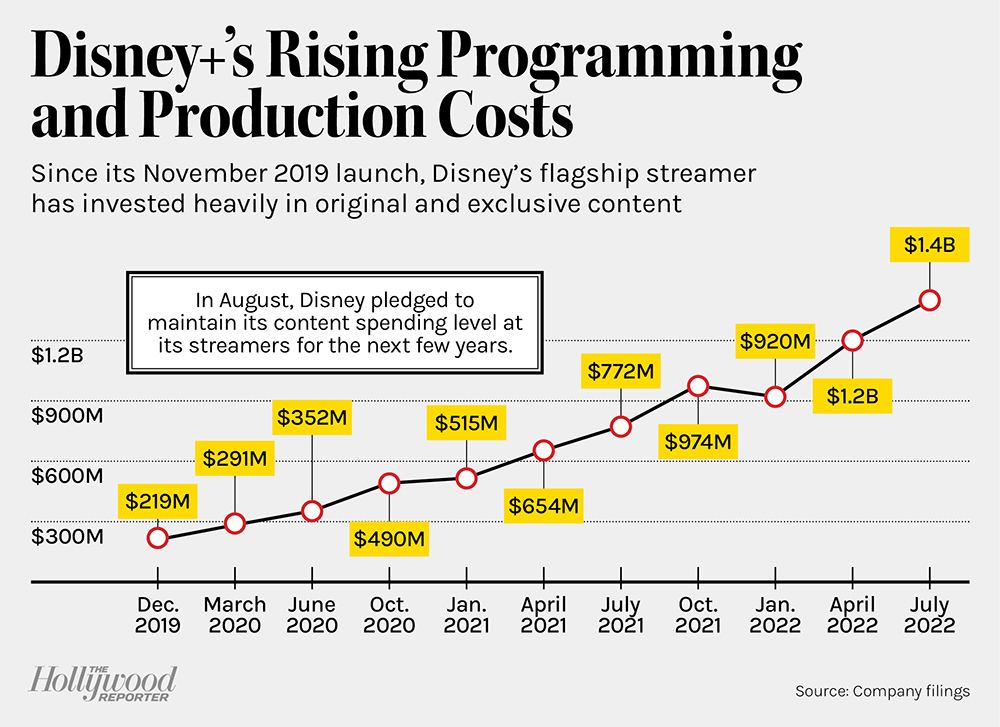

But now, profitability concerns reign. With the boost from the pricing for the ad tier, which Chapek said has also seen “strong advertiser demand,” adding to the bottom line, as well as the price increase for its ad-free tier, Disney reaffirmed its guidance for profitability for its streaming segment in 2024. This is balanced out by the company’s plan to keep the rate of content spending for all its platforms at around $30 billion for the next few years and its measured revision of subscriber goals. “It now looks like Disney+ is tracking towards tightened and trimmed sub guidance, while the ad-supported tier + price increases + content rationalization = a much improved long-term profit outlook,” Wells Fargo analyst Steven Cahall wrote in an Aug. 11 note.

Disney’s focus aligns with the thinking on Wall Street, where some see subscriber numbers as more of a placeholder metric before streamers reached profitability, says Bank of America analyst Jessica Reif Ehrlich. Subscriber numbers were already a problematic measuring stick, she adds, because they are “backward looking” and also volatile due to the level of subscriber churn. “Ever since Netflix stumbled in Q1 and Q2, the valuations have changed,” Reif Ehrlich notes.

Warner Bros. Discovery also helped shift the focus in the streaming landscape, with CEO David Zaslav zeroing in on cost-cutting measures at the media conglomerate and avowing not to overspend on content. “We’re not in the business of trying to pick up every sub. We want to make sure we get paid,” he quipped on an Aug. 4 earnings call.

The focus on profitability raises questions about Netflix’s approach to its ad tier, which is the next to launch in early 2023. Asked whether Disney’s pricing has any impact on Netflix’s plans, a spokesperson for the company says there have been no updates since the company’s second-quarter earnings report in July.

Executives at Netflix did not set a price at that time, but Greg Peters, Netflix’s chief operating officer, spoke to “a lower consumer-facing price to be able to attract a broader set of members,” echoing Disney’s initial comments. Still, he noted that given the expected ad revenue on that tier, the monetization would likely be “equal or maybe even better” than on the ad-free tier.

Netflix’s offerings are already priced higher than Disney’s, limiting the company’s potential upside in an inflationary environment. Warner Bros. Discovery has also announced plans to launch an ad-supported tier after it combines the streaming platforms of HBO Max and Discovery+, with pricing to be determined. “Disney had optionality that others probably don’t, because they were underpriced,” Reif Ehrlich says.

While the price increases could lead to users unsubscribing, Disney executives have pledged to launch the ad tier with a “thoughtful approach,” which includes a lower advertising load when the platform first debuts and with deals on bundled packages of Disney+, ESPN+ and Hulu. Executives have also noted a lack of subscriber churn at ESPN+, even with a $3 increase for its monthly price starting in August.

This, in addition to the eventual arrival of theatrical releases such as Avatar: The Way of Water to the platform, alongside the company’s normal rollout of content, is expected to help the streamer keep subscribers. As Goldman Sachs analyst Brett Feldman wrote in an post-earnings take: “While we see some risk that subs may churn instead of watching ads or paying more, we believe that the alignment of these pricing moves with a material expansion in new original content should minimize this potential headwind.”

This story appeared in the Aug. 17 issue of The Hollywood Reporter magazine. Click here to subscribe.