Mark your calendar: On Jan. 29, Amazon will unleash what one top advertising executive calls a “tornado” that will “upend” the streaming video landscape. The company will flip a switch and turn on ads for all of its Prime Video viewers. Users will have the option to pay $3 a month to remove the ads, but as the executive quips: “Almost no one will do that, are you kidding me?”

After all, people are paying Amazon for the fast shipping. Reacher and Thursday Night Football are thrown in for free. It’s a move that has marketers salivating and a few legacy media executives anxiously waiting to see what happens.

The move will instantly turn Amazon into a streaming-ad juggernaut, and the largest ad-supported subscription streaming platform in the marketplace with tens of millions of users, leapfrogging the likes of Netflix in the process.

Amazon, run by Andy Jassy, has always been coy about just how many Prime subscribers it has (the last official number, in 2021, was “more than 200 million”), but no one disputes that its reach is almost unrivaled. Consumer Intelligence Research Partners estimates that there are about 168 million Prime subs in the U.S. alone, as of 2023.

If just half those subs watch Prime Video content, it would be comparable to Netflix’s penetration in the U.S. (77 million) and significantly more subs than the likes of Hulu, Peacock or Paramount+.

Data from Nielsen reinforces that: While Netflix and YouTube take up the lion’s share of viewing time, Prime Video is extremely competitive. The latest Nielsen Gauge reported that 3.4 percent of TV viewing in November was Prime Video, compared to 2.7 percent for Hulu, 7.4 percent for Netflix and 9 percent for YouTube.

The Gauge certainly suggests that if Hulu has just shy of 50 million subscribers, as Disney has reported, then Amazon is at least in the same ballpark in terms of Prime subs that watch video content.

Most Netflix users, however, are not subscribing to the ad tier (the company said in November it had only 15 million “active users” of the tier), while some Hulu subcribers also opt out of ads.

That scale, in both subscriber reach and real viewership, has analysts thinking that Amazon will be able to quickly scoop up billions of ad dollars. Bank of America’s Justin Post estimated in a Jan. 3 note that the company will ultimately generate $3 billion in new ad revenue from the switch, and nearly $5 billion when accounting for users who opt to pay not to see ads. LightShed’s Rich Greenfield estimates that the company will hit $2 billion in ad revenue this year. Both analysts assume that the overwhelming majority of users will opt not to pay extra to remove the ads.

It’s that instant scale that has marketers excited and competitors concerned. Prime Video with ads will be premium video, including dramas, comedies and library fare, as well as live sports like NFL and NASCAR — the content and reach of TV, with the targetability of a tech company. It’s a sweeping change for the platform. (And, in turn, division leader Mike Hopkins sent a Jan. 10 memo to staff stating that Prime Video and MGM Studios “identified opportunities to reduce or discontinue investments in certain areas while increasing our investment and focus on content,” resulting in the losses of hundreds of jobs.)

Kevin Krim, CEO of the ad measurement firm EDO, estimates that Amazon could see a CPM (the cost per thousand consumers who see an ad) of about $50, below what Netflix sought when it got into advertising a little over a year ago, but still “a big premium to linear TV.”

And advertising is also a zero-sum game. While ad spend has grown over time as the economy has expanded, when a marketer or agency decides to commit budget to a new player, it is usually at the expense of someone else.

This time around, a likely victim is linear TV, with S&P Global’s Naveen Sarma writing Jan. 3 that “we believe advertisers have permanently left legacy platforms, including national TV.”

One high-level TV ad executive says they are beginning to plan out 2024 with an expectation that some of their inventory will be poached by Amazon.

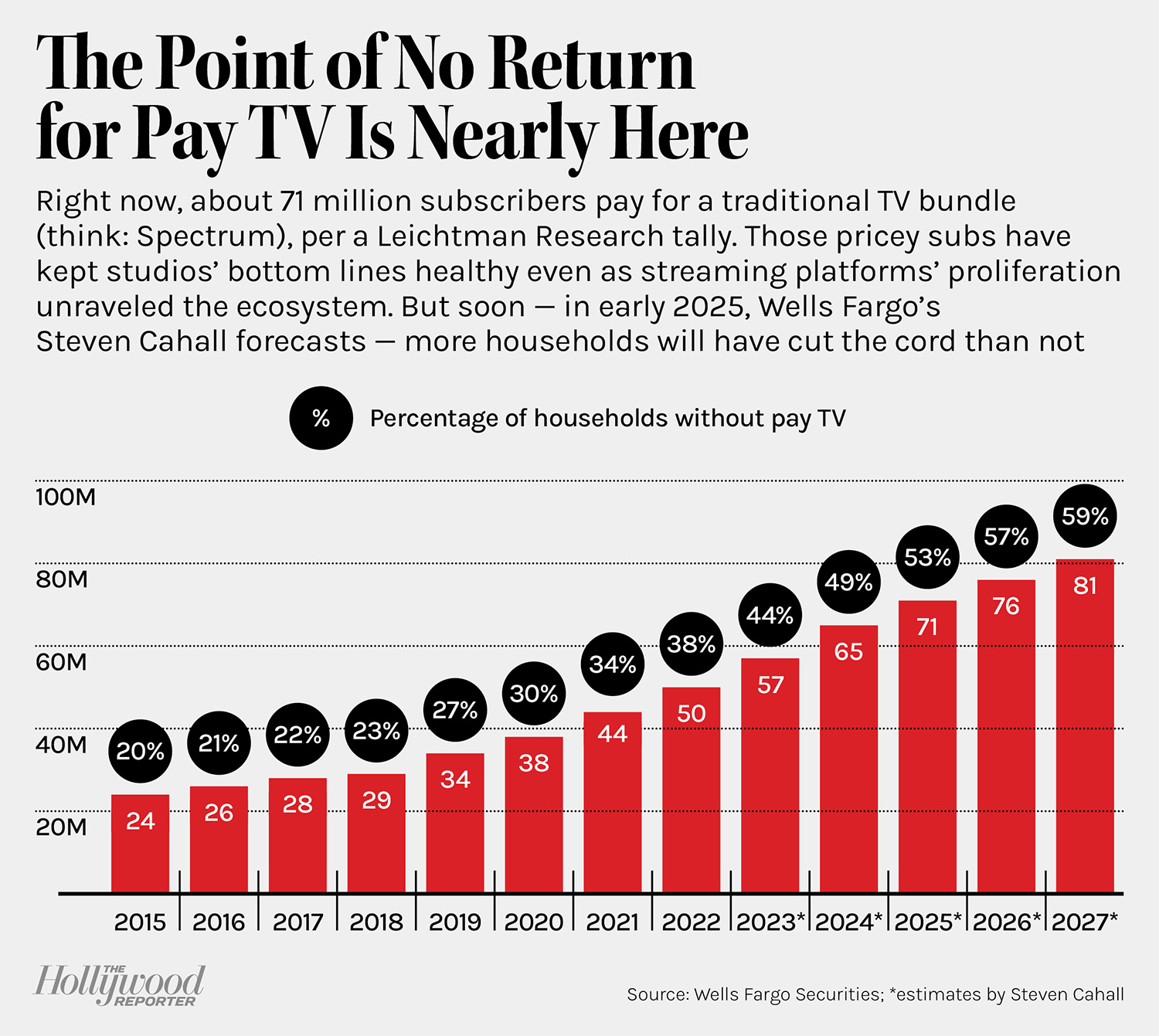

Indeed, declining audiences in linear TV have been a concern of ad executives for years, which is why every legacy media company has invested so heavily in streaming video — and why many of those legacy companies are all in on ad-supported streaming, supplementing them with their strongest linear assets, be they broadcast networks or the increasingly small number of scaled cable channels.

“Yes, linear is declining. Not all linear is declining equally,” Disney ad sales chief Rita Ferro said during an interview on LinkedIn on Jan. 4. “And I do foresee a shift in how we use that — I call it real estate space, if you will — on our broadcast network. What is the right content for the right experience at the right time across all those platforms? And I do foresee that that will drive growth.”

The investment in streaming video by legacy companies (think Paramount+, Peacock, Max, Hulu and Disney+) should help to offset the decline in linear (Disney+ and Peacock, for example, are seeing robust ad growth), but multiple sources say that Amazon’s foray into the space complicates things.

The one big advantage that these companies have over the likes of Amazon and Netflix is their experience selling ads. For big-budgeted marketers, big media is a familiar, tested partner.

“We’ve had a couple-year head start,” NBCUniversal ad sales chairman Mark Marshall says, noting that Peacock launched with an ad tier. “We’re not trying to retrofit our platform into supporting advertising. I think we’ve built it from within for advertisers, so I think we already have a strategic feel of what it should be.”

TV will not be the only loser, of course. Krim notes that “anything that’s not video is competing with video… I think the net losers here are actually going to be anything that’s not video-first, which includes a bunch of regular social media text ads or non-video ads.”

But it’s also worth noting just how different Amazon’s approach is to getting into ads. Disney+, Netflix, Paramount+ and Max all launched their ad tiers as cheaper alternatives to their core ad-free offerings. And while there have been price hikes that could gently nudge consumers to those ad tiers, none of those services have automatically switched users over. A majority of Hulu’s users are on its ad tier, but it launched in 2010, years before most of its competitors existed in any form.

Executives at multiple companies have said that they make more per subscriber on their ad tiers than on their ad-free tiers, with the ad dollars more than making up for the lower sub fees.

But while other services have tried to entice viewers into trying their ad tiers, Amazon is ripping off the Band-Aid, betting that few users will care. And if it works, a top holding company exec predicts that others will follow.

Streaming video has been competitive for years, but it is entering a new era where the revenue needs to justify the costs. If Netflix was the lodestar for the first round of the streaming wars, YouTube appears to be the target for round two.

In its latest quarter, YouTube had just under $8 billion in advertising revenue, putting it on track for about $30 billion in ad revenue in 2023. That’s just advertising revenue, and does not include subscription fees for services like YouTube TV or YouTube Premium.

It’s an enormous number, one that has to have major appeal for the likes of Disney, Netflix and, yes, Amazon. If the past few years were about seeking subscriber scale, the next five may be defined by who can build the biggest streaming ad business. And Amazon is about to speed past some of its rivals and eat linear TV in the process.

What About Amazon’s Other Streamer?

As Prime makes its ad tier its default, the road map for its ad-supported platform Freevee (home to Bosch-land) isn’t as clear.

Amid Amazon’s streaming ad power play, there is one big quirk: It already has an ad-supported streaming service. The Lauren Anderson-run Freevee (formerly called IMDb TV) has been programming library fare and a handful of original shows since 2019. And just in the past year it has even had some breakout hits, including Jury Duty, Primo, High School and Judy Justice.

If Prime Video is adding ads, what will it mean for the company’s other ad-supported streaming service — one that, as it happens, was a focal point of its upfront presentation last May?

Sources say it will be business as usual at the platform, which is free and open to non-Prime members. Some executives from Freevee’s tech side have been brought over to help with the launch of the ad tier on Prime Video and are either pulling double duty for the two platforms or have moved to the flagship service exclusively to help get its ad platform up and running as quickly as possible.

Just as Paramount puts library content on Pluto TV to help drive subs to Paramount+, and just as Warner Bros. Discovery has become keen on licensing some library content (including HBO shows) to some FAST platforms, Amazon seems intrigued by the two-pronged strategy as well.

Execs within Amazon, sources say, are pleased with Freevee’s growth and are keen on keeping the free streamer, which they see as an on-ramp of sorts to Prime Video after the ad-supported audience was exposed to programming like Reacher and helped grow viewership for its second season on the subscription service.

Freevee’s programming team, sources say, has already lined up slates of originals for this year and next and is discussing plans for 2026. — A.W. and Lesley Goldberg

A version of this story appeared in the Jan. 10 issue of The Hollywood Reporter magazine. Click here to subscribe.