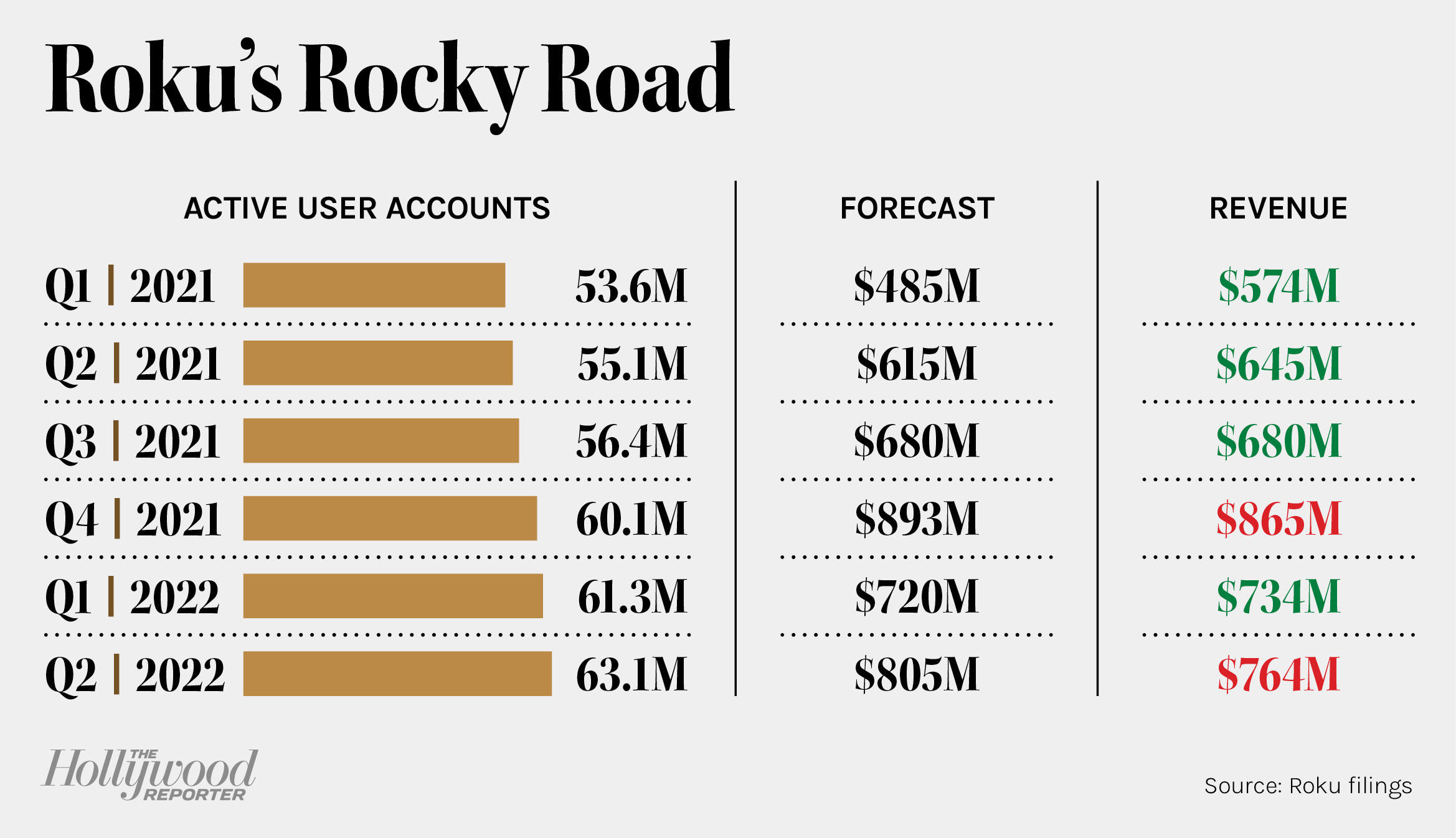

Roku was particularly impacted by the advertising slowdown, which also has hurt other ad-reliant companies such as Snap and Meta. The downturn hurt Roku’s second-quarter revenue and caused the company to pull its full-year guidance because of the uncertain economic environment. To make up for its pressured margins, the Anthony Wood-led Roku said July 28 it would slow its rate of hiring and pull back on operating expenses. This includes its content spend, the bulk of it made up of third-party licensing, but which also includes investment in its Roku Originals channel. (“Spend will be commensurate not only with the scale and growth of The Roku Channel, but also with the broader macro environment,” was the measured statement in the firm’s earnings release.)

These are some of the only levers that the company can pull, analysts say, as it waits for an improvement in the broader economy. The previous quarter created somewhat of a perfect storm for Roku, according to MoffettNathanson analyst Michael Nathanson. “Roku’s 2Q 2022 results were the sum of all our worries,” he wrote in a July 29 note.

Nathanson fears that Roku’s numbers, like other companies’, had been elevated by consumer demand for streaming video during the pandemic and propped-up higher advertising spend in 2021. But, as the second quarter showed, Roku’s advertising, which is easy to turn off and on, appears more susceptible to a recession than traditional TV advertisers. At the same time, the company is facing competition on three sides, Nathanson writes. There’s Amazon, Alphabet and others in the connected TV space, increasing competition among the traditional streaming companies and, soon, a battle for ad dollars with Netflix and Disney+, after the two platforms launch their ad-supported streaming tiers next year. This, in addition to continued advertising woes, will likely mean Roku’s stock is pressured in the near term.

Still, for many analysts, the bad news does not change their long-term view of the company’s prospects. On one hand, the entrance of media giants Netflix and Disney into ad-supported streaming could help bring more advertisers into the streaming space from linear television, CFRA analyst Kenneth Leon wrote in a July 29 note. (The company also underlined this point in its recent earnings call.) Yet CFRA analysts downgraded Roku from “hold” to “sell” and lowered its price target from $70 to $57.

Guggenheim analysts, which lowered Roku’s price target to $70 from $115, offered a more bullish view in a July 28 note: “We share management’s favorable view of the long-term CTV opportunity, (note Roku surpassed $1bn in upfront commitments), but believe the company needs to show a return to profitable growth to renew investor interest.”

And, even while acknowledging that the past quarter’s results will “likely rattle already rattled investors,” Wells Fargo analyst Steven Cahall views the stock price ($75.71 a share at the close of business Aug. 2) as an attractive entry point ahead of an expected connected television (CTV) boom. “This is a shock for the stock because CTV was believed to be a secularly growing ad channel and thus should have proven less volatile and/or gained share in a recessionary environment,” Cahall wrote. “While that could happen later in this cycle, in the near term it looks as though marketers are cutting budgets on CTV because they can.”

Cahall added, “For those with the ability to look through an ad recession, this could be a great price for Roku post-recession.”

A version of this story appeared in the July 27 issue of The Hollywood Reporter magazine. Click here to subscribe.