The number of feature films receiving tax credits to shoot in California are on the rise, with some productions spending big bucks to nab major incentives along the way.

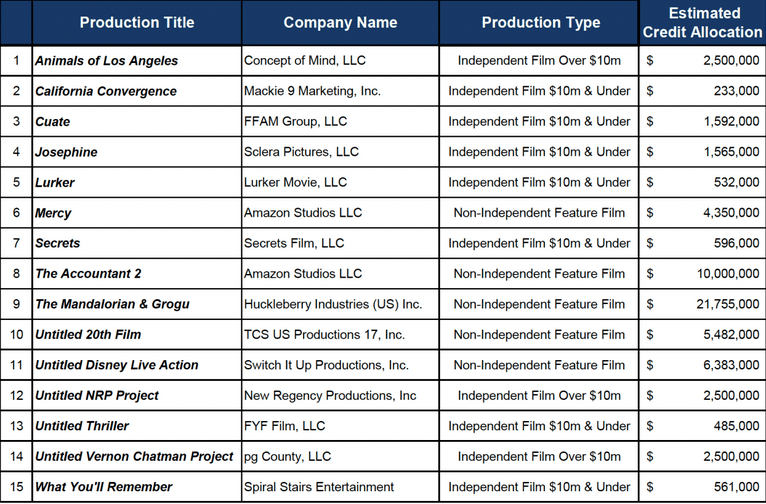

Led by The Mandalorian & Grogu, five studio projects were selected to participate in California’s Film and TV tax credit program, the state’s film office announced on Monday. The Lucasfilm title will get $21.8 million in tax credits, becoming just the fifth movie in the history of the program to get at least $20 million. Three of those films were selected in the past two years and were chosen in consecutive quarters.

Disney was the biggest beneficiary in this round of incentives, with titles from the entertainment giant conditionally receiving $28.1 million to shoot in the state. Amazon Studios will also get $14.4 million for a pair of projects, including the Ben Affleck-led The Accountant 2. Absent from the list was Netflix and Warner Bros., which have mostly led the way in credit allotments over the past three years.

As more big budget titles increasingly opt to shoot in other states with more generous tax incentives, it appears that California is attempting to lure productions back to the area by offering more credits. Conversely, some productions are setting record marks in total qualified expenditures, which determine the amount in credits they receive.

“The array of film projects announced today demonstrates California’s enduring attraction for storytellers,” said California Film Commission Executive Director Colleen Bell in a statement. “These productions, spanning big-budget features to indie films, not only infuse millions into our economy but also showcase our state’s talent and versatility.”

Jon Favreau’s The Mandalorian & Grogu, the first Star Wars feature that will shoot in California, is expected to spend roughly $166 million in below-the-line wages and qualified spend — the largest figure in the history of the state’s tax incentive program. The amount eclipses projections from Quentin Tarantino’s final project, which was granted $20.2 million in credits for generating what was then a record $128.4 million in qualified spending. That figure also surpassed the record set by Lionsgate’s Michael Jackson biopic Michael ($120.1 million), which was selected to receive credits last year.

Unlike other high-production states like Georgia, only the qualified spending portion of a movie’s budget, which does not include compensation for talent, is eligible for credits in California. In a bid to curb runaway production, the state last year passed a measure that will make the credits refundable for the first time since the program’s inception in 2009, beginning in 2025.

“We are thrilled to be shooting the next Star Wars movie, The Mandalorian & Grogu, here in California,” said a Lucasfilm spokesperson in a statement. “Working with the California Film Commission, we are proud to be creating film jobs in California and excited to start production, utilizing the world class crew available here.”

Other studio projects that will receive tax credits include untitled movies from Disney ($6.4 million) and 20th Century Studios ($5.5 million), as well as Amazon Studios’ The Accountant 2 ($10 million) and Mercy ($4.4 million).

“We are thrilled to be able to shoot in Los Angeles thanks to the tax credit,” said Academy Award nominated producer Charles Roven, who is set to produce the Chris Pratt-led Mercy, in a statement. “We get to work with terrific talent that lives here and utilize the wonderful locations. And almost everyone gets to go home to their own bed at the end of day!”

Ten independent movies will also collectively get an estimated $13.1 million for generating roughly $114 million in qualified spending, with $70 million attributed to below-the-line wages. They are headlined by New Regency’s untitled NPR project ($2.5 million).

The California Film Commission received a total of 59 applications during this feature film tax credit allocation period. The next application period for features is slated to open in August. Submissions for recurring and relocating TV series is open from Feb. 26-28 and new TV series from March 4-6.