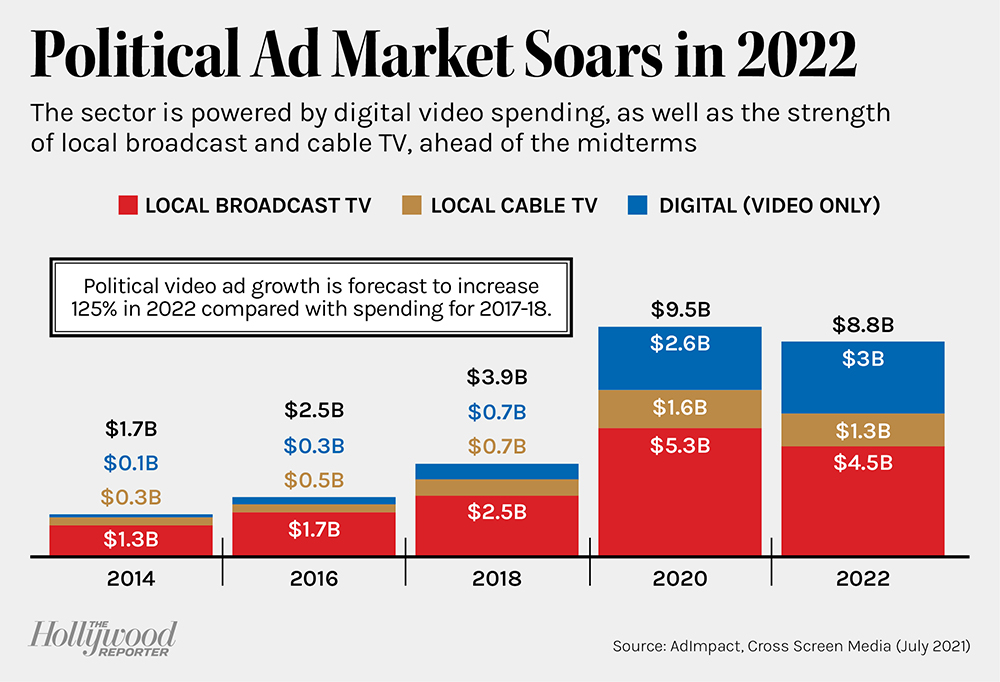

Source: AdImpact, Cross Screen Media

It may be a midterm election year, but it’s looking like 2020 all over again — at least when it comes to political campaign cash. And local TV stations, some national cable channels and streaming firms with exposure to local advertising are the big beneficiaries.

Midterm elections have always been good for the advertising business, particularly for local TV, where stations can fill nearly every hour with ads from multiple campaigns and PACs. This year, however, things don’t look good for business. They look great.

Hotly contested races in states like Pennsylvania (where Lt. Gov. John Fetterman prevailed in the Democratic Senate race), Ohio (where Trump-endorsed Hillbilly Elegy author J.D. Vance won in the GOP Senate primary) and North Carolina (which saw the state’s chief justice, Cheri Beasley, win in the Democratic Senate primary) have pumped cash into local TV stations. There are still tough primaries ahead in Georgia, Wisconsin and Arizona. And that says nothing of states like New York, where the gubernatorial candidates have bought $20 million worth of campaign ads so far, according to a review of their records.

Marketing analytics firm Cross Screen Media had been projecting a bullish $8.8 billion in advertising buys for the 2022 midterms (by way of comparison, spending was $9.5 billion during the 2020 presidential election and $3.9 billion for the 2018 midterms). “From where we are at today, we are ahead of that [$8.8 billion] pace,” Cross Screen Media CEO Michael Beach says. “It’s going to double 2018. We are at 128 percent growth right now; it’ll clobber [2018].”

What’s happening is that campaign war chests and outside Super PACs are overflowing with cash thanks to efficient and effective online fundraising efforts. And with a majority of campaign spending used on paid media, it is flowing downstream.

“Money raised equals money spent. Money never gets returned,” Sinclair Broadcast Group CEO Chris Ripley said during a May 19 conference hosted by the research firm MoffettNathanson. “There is a lot of money chasing politics right now.”

Adds Beach, “The pie as a whole is growing so fast that total dollars are growing rapidly.”

And nowhere is that clearer than with broadcast TV, which has seen its viewership ratings tumble double digits annually for years. But with a need to reach all voters in a geographic area, whether they are cord-cutters or loyal local TV watchers, campaigns are spending freely.

Indeed, executives at companies with exposure to local TV stations are not shy about expressing their enthusiasm for the current situation. Sinclair, which owns or operates 193 stations across the U.S., reported $13 million in political revenue for the first quarter, which is tracking above expectations. “Some of these primary races are crazy,” Ripley said. “Q2 is bigger than Q1, Q3 will be bigger than Q2. The really big money starts hitting in Q3 and Q4.”

Fox Corp. saw a record $180 million in political advertising spending in the previous midterm election and expects to surpass that this year. “From what we’ve already seen with spending in the primaries, we expect this midterm election to blow through that $180 million record in revenue pretty significantly, pretty substantially,” Fox CEO Lachlan Murdoch said May 18 during an analyst conference.

(As it happens, Fox executive chairman Rupert Murdoch donated $200,000 to a pro-David McCormick PAC in the deadlocked, as of press time, Pennsylvania Senate race against TV host Mehmet Oz, according to Federal Election Commission records.)

Nexstar Media Group, which has 200 broadcast stations across the U.S., reported political advertising revenue of $23.7 million in its most recent quarter, something the company said is reflective of “strong early midterm election spending.”

“We continue to have excellent three-year visibility on our growth trajectory given expected strong midterm and presidential political advertising and distribution agreement renewals representing a significant percentage of our subscribers over this period,” CEO Perry Sook said during his company’s latest earnings call.

Gray, the second-largest TV broadcaster in the U.S. with its 113 markets, reported strong revenue growth in the first quarter, reaching $26 million in the three months ended March 31, up from $9 million in 2021, an “off year” for elections in general. “Our total revenues of $827 million were strong as we begin an ‘on year’ of the two-year political advertising cycle,” the company wrote in its first-quarter earnings report.

But as hot as the market is for TV and media companies, it can be bleak for consumers, who find themselves bombarded by more campaign ads than ever, from more backers with more cash than ever. It’s a tidal wave of attack ads, which helps explain why Gallup’s latest annual survey of trust in institutions — from political leaders to the media to big business — shows all of them at historic lows.

The U.S. political climate seems unlikely to cool off soon, with contentious primary races and general election campaigns all but assured to continue into the next cycle and beyond. The result is likely more negativity — and a lot more money in the system.

“On the one hand, I lament that we’re in the political environment that we are,” Ripley said at the MoffettNathanson conference. “On the other hand, it’s very good for our business.”

Source: AdImpact, Cross Screen Media

This story first appeared in the May 25 issue of The Hollywood Reporter magazine. Click here to subscribe.