Source: Company reports, MoffettNathanson estimates and analysis

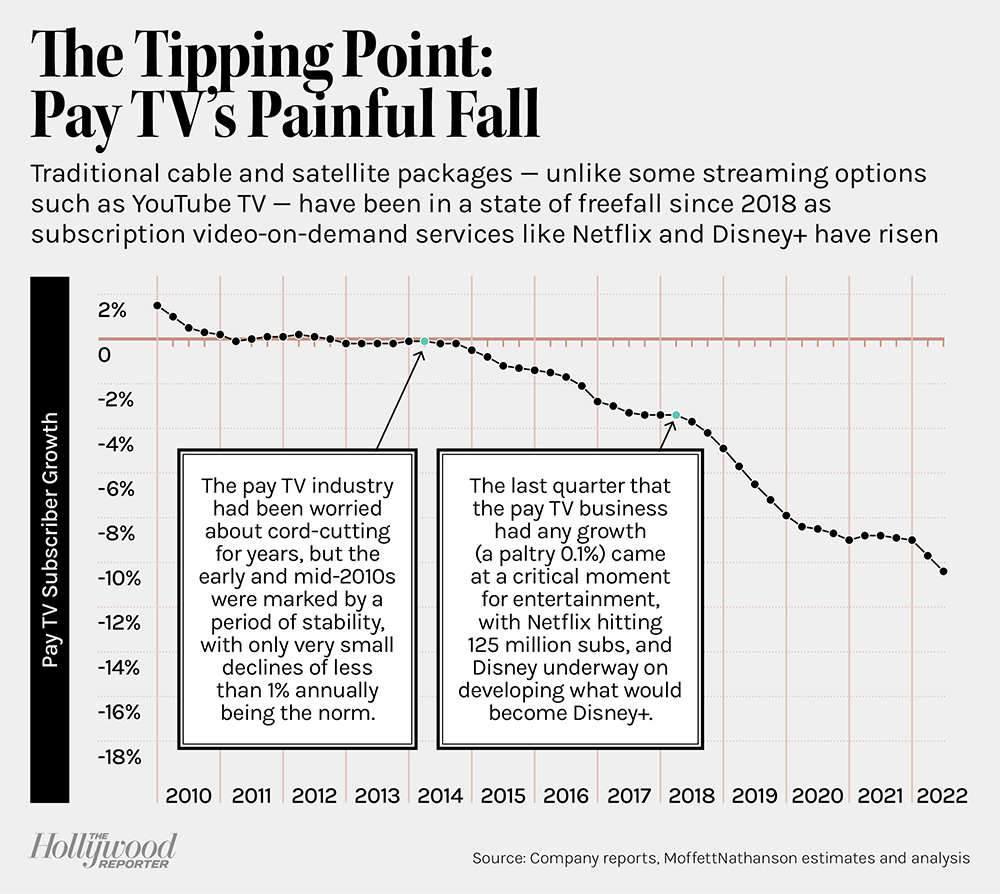

Across every major studio, economic emergency brakes have been pulled, with hiring freezes, enhanced scrutiny on travel and entertainment expenses, and, yes, layoffs. In the legacy media world, where studios have been betting on streaming to make up for declining cable revenues, it also has provided a gut check. Profits are still years off for many, and the economic headwinds are accelerating cost-cutting measures that may have already been in motion as executives, and Wall Street, get more pragmatic about streaming.

AMC Networks laid out this case explicitly in its Nov. 29 memo, in which executive chairman James Dolan explained the need for “a large-scale layoff as well as cuts to every operating area” at the company. “It was our belief that cord-cutting losses would be offset by gains in streaming. This has not been the case,” Dolan wrote. “We are primarily a content company and the mechanisms for the monetization of content are in disarray.” Wall Street was initially startled by this direct statement (as well as by the departure of recently appointed CEO Christina Spade), but a source close to Dolan tells The Hollywood Reporter that he was surprised by that reaction, given how “obvious” the problem facing the industry is.

Macroeconomic trends are hurting linear advertising dollars, which companies had used to help support investments in streaming. And while companies with live sports may be able to leverage those events to minimize damage to their advertising businesses (Fox, for example, says that its sports ad business continues to boom), pure-play entertainment companies will feel the most pain, due to the macroeconomic hit, in addition to secular challenges.

Many pure-play entertainment companies are facing an “existential threat,” says Peter Csathy, chairman of Creative Media, largely because the pivot toward streaming has yet to be fully realized. “The economics just don’t work,” Csathy adds. “In this streaming-first world, the content budgets are too high. The revenues that come in are too low in a hyper-competitive world where everybody’s chasing the same streaming dollar.”

At the same time, cord-cutting is accelerating, with the largest pay TV providers in the U.S. recording a loss of 785,000 net video subscribers in the latest quarter, compared to a loss of 650,000 a year ago, according to a Leichtman Research report.

As a smaller studio competing against giants, AMC Networks has been particularly affected. The company just hit 11.1 million paid streaming subscribers (compared to Disney’s combined 236 million streaming subscribers and Netflix’s 223 million) and grew its streaming revenue 40 percent in the most recent quarter, but still saw overall net revenue decrease 16 percent year-over-year. Part of this came from a drop in advertising revenue related to the economic climate, but the company also saw a decline in ratings on the linear side as more consumers cut the cord.

And even while subscriber growth has ticked up at streamers, analytics company Antenna found an increasing level of churn among the top premium streaming services (including Netflix, HBO Max and Disney+), potentially a sign of consumers cutting back amid rising inflation. There were more than 32 million cancellations among those 10 premium services in the third quarter of 2022, compared to 28 million in the prior two quarters.

While some of these trends had been happening for some time, over the past year Wall Street has been turning more against streaming-focused companies that have yet to realize a profit. And in response, executives have become more focused on the bottom line. That, combined with the current fears of an economic recession, accelerated cuts and layoffs that would have needed to happen eventually, Csathy said.

“These forces have been around pre-the drop in Dow, but certainly the tough times that everybody’s facing right now is giving cover to companies to take action now,” he said. “It’s easier for company A to make major layoffs when you see your competitors already doing the same.”

Paramount Global CEO Bob Bakish underlined this thesis at an investor conference on Dec. 6. The company recently reorganized its ad sales division, and the Paramount and CBS TV studios saw dozens of layoffs in November. “We are embarking on a set of initiatives, which we were planning on doing anyway, but we are definitely accelerating and using the current market as a catalyst,” Bakish said.

At Disney, Bob Iger has said he plans to keep in place former CEO Bob Chapek’s hiring freeze, as he analyzes the company’s spending, including its record investments in streaming. He is already planning to restructure the Disney Media and Entertainment Distribution division, and other business units are expected to follow.

At Warner Bros. Discovery, the company is in the midst of deleveraging and expects to take as much as $1.1 billion in restructuring charges as it cancels projects and cuts departments in pursuit of cost-saving measures and achieving streaming profitability. AMC Networks expects to take as much as a $75 million charge related to its layoffs.

The other savior for these media companies may be the addition of ad-supported streaming tiers, which many are in the process of launching. The ability to lower prices at a time of rising inflation could make up for the temporary challenge of a weak advertising market.

The consultancy firm Deloitte, in its 2023 predictions report released Nov. 30, said that by the end of 2023, two-thirds of consumers in developed markets will use at least one ad-supported streaming service, and that even more major ad-free streaming services will launch ad-supported tiers. Disney+ and Netflix have already announced their offerings, and Warner Bros. CEO David Zaslav has said there’s one planned at his company. Furthermore, by the end of 2024, Deloitte predicts that half of all streaming video on-demand providers will have a free, ad-supported option, similar to Paramount’s Pluto TV.

Speaking at a Dec. 5 investor conference, NBCUniversal CEO Jeff Shell said that there’s “no question cord-cutting is accelerating” and has impacted business this quarter. This comes as employees meeting certain age and tenure requirements have been able to take early retirement packages, and layoffs are expected to follow in the coming months. But Shell said this is just part of a bigger “reorganization” as the company finds new ways to invest more in streaming, adding: “You have to take costs out of linear as that business declines and try to maintain your margins.”

Source: Company reports, MoffettNathanson estimates and analysis

A version of this story first appeared in the Dec. 7 issue of The Hollywood Reporter magazine. Click here to subscribe.